Nifty 50: Top losers today - 20 December 2024

Technical Indicators Overview for NIFTY 50 Top Losers

1. Tech Mahindra Ltd. (TECHM)

- % Change: -3.89%

- Points Change: -68.30

- Open: ₹1770 | Close: ₹1686.05

- 50 EMA: ₹1741 - Tech Mahindra is trading below its 50-day EMA, indicating a bearish short-term trend.

- 200 EMA: ₹1733 - The price is below the 200-day EMA, confirming a long-term bearish sentiment.

- RSI: 39.02 - The RSI approaching oversold territory could suggest a potential rebound.

- MACD: -5.66 - A negative MACD indicates strong bearish momentum.

- MACD Signal: 12.78 - The negative signal further supports a continued downward movement.

2. Axis Bank Ltd. (AXISBANK)

- % Change: -3.34%

- Points Change: -37.05

- Open: ₹1103.95 | Close: ₹1071.85

- 50 EMA: ₹1142 - Axis Bank is trading below its 50-day EMA, indicating a short-term bearish outlook.

- 200 EMA: ₹1145 - The stock is below the 200-day EMA, supporting a long-term downtrend.

- RSI: 24.24 - The RSI below 30 signals an oversold condition, suggesting potential for a price reversal.

- MACD: -9.68 - The negative MACD supports a bearish momentum in the stock.

- MACD Signal: -2.74 - The MACD signal supports a continued downward movement for Axis Bank.

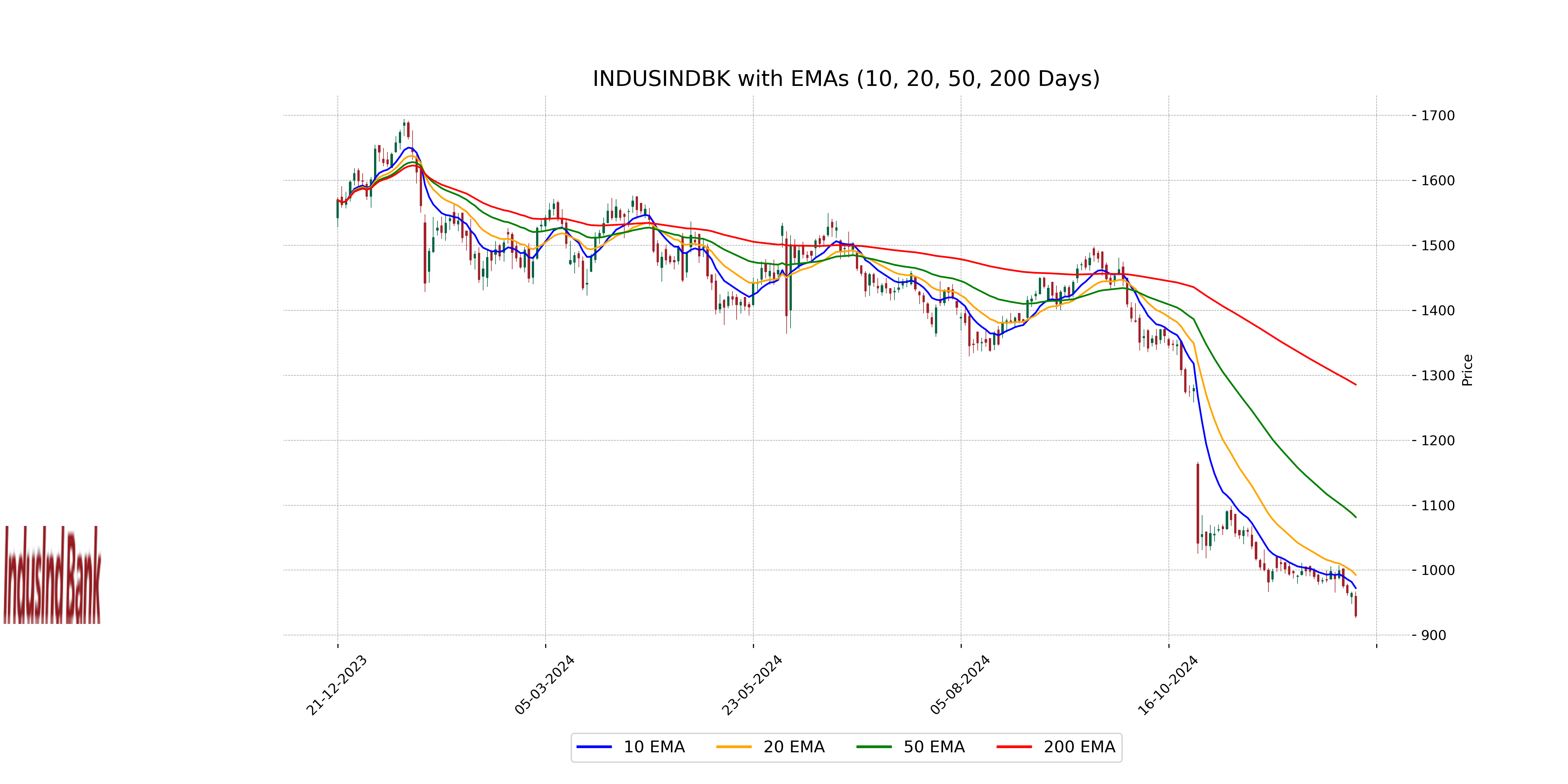

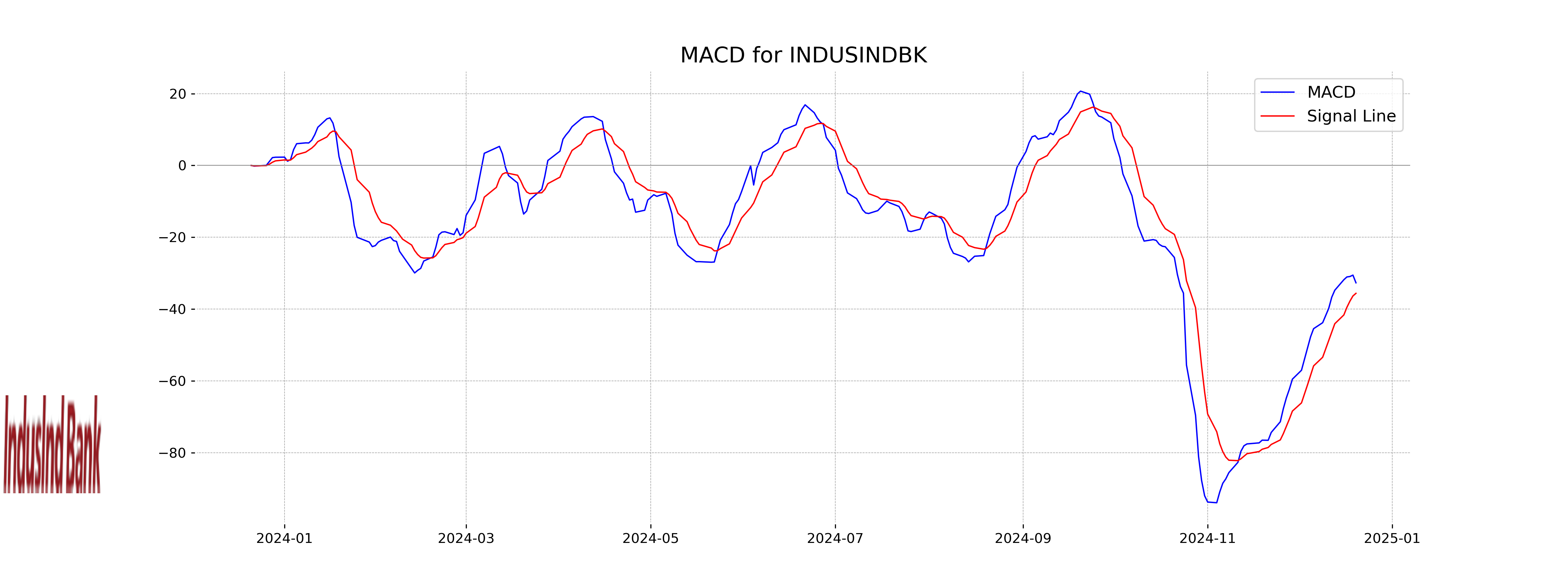

3. IndusInd Bank Ltd. (INDUSINDBK)

- % Change: -3.62%

- Points Change: -34.95

- Open: ₹960 | Close: ₹929.45

- 50 EMA: ₹995 - IndusInd Bank is trading below the 50-day EMA, indicating a short-term bearish trend.

- 200 EMA: ₹1003 - Below the 200-day EMA, confirming a long-term downtrend.

- RSI: 22.65 - With an RSI below 30, the stock is in oversold territory, signaling a potential price reversal.

- MACD: -12.54 - The negative MACD reflects ongoing bearish pressure.

- MACD Signal: -8.80 - The negative MACD signal suggests that the bearish trend will likely continue.

4. Mahindra & Mahindra Ltd. (M&M)

- % Change: -3.59%

- Points Change: -108.30

- Open: ₹3014.65 | Close: ₹2906.35

- 50 EMA: ₹3000 - M&M is trading below its 50-day EMA, indicating short-term bearishness.

- 200 EMA: ₹2987 - The price below the 200-day EMA signals a long-term downtrend.

- RSI: 38.40 - An RSI approaching oversold levels suggests a potential price reversal if buying momentum picks up.

- MACD: 9.08 - A positive MACD indicates potential bullish momentum.

- MACD Signal: 22.03 - The MACD signal points toward a potential upward movement, despite the recent decline.

5. Trent Ltd. (TRENT)

- % Change: -3.67%

- Points Change: -260.45

- Open: ₹7125 | Close: ₹6831.55

- 50 EMA: ₹6833 - Trent Ltd. is trading near the 50-day EMA, indicating support at this level.

- 200 EMA: ₹6787 - The price is just above the 200-day EMA, showing a neutral long-term outlook.

- RSI: 47.40 - The RSI is in the neutral zone, meaning there is no clear signal for an imminent trend reversal.

- MACD: 70.56 - The positive MACD suggests the potential for upward movement in the stock.

- MACD Signal: 76.28 - The MACD signal indicates that if the trend continues, the stock may experience a rebound.

Key Takeaways for Traders and Investors

Tech Mahindra Ltd. (TECHM), Axis Bank Ltd. (AXISBANK), and IndusInd Bank Ltd. (INDUSINDBK) show signs of continued bearish momentum as they trade below their key moving averages (50 EMA and 200 EMA) and have negative MACD readings.

The RSI readings for these stocks indicate that they are in oversold territory, which could signal potential reversals if buying pressure increases.

Mahindra & Mahindra Ltd. (M&M) and Trent Ltd. (TRENT) show mixed signals, with M&M demonstrating a potential rebound based on its MACD and RSI, while Trent Ltd. may experience upward momentum if the current positive trend continues.

By monitoring these technical indicators, investors can gain deeper insights into the short-term and long-term trends of these stocks, ultimately aiding in their investment decisions.