Highlights

- Nifty 50 Top Losers Today 20 December 2024

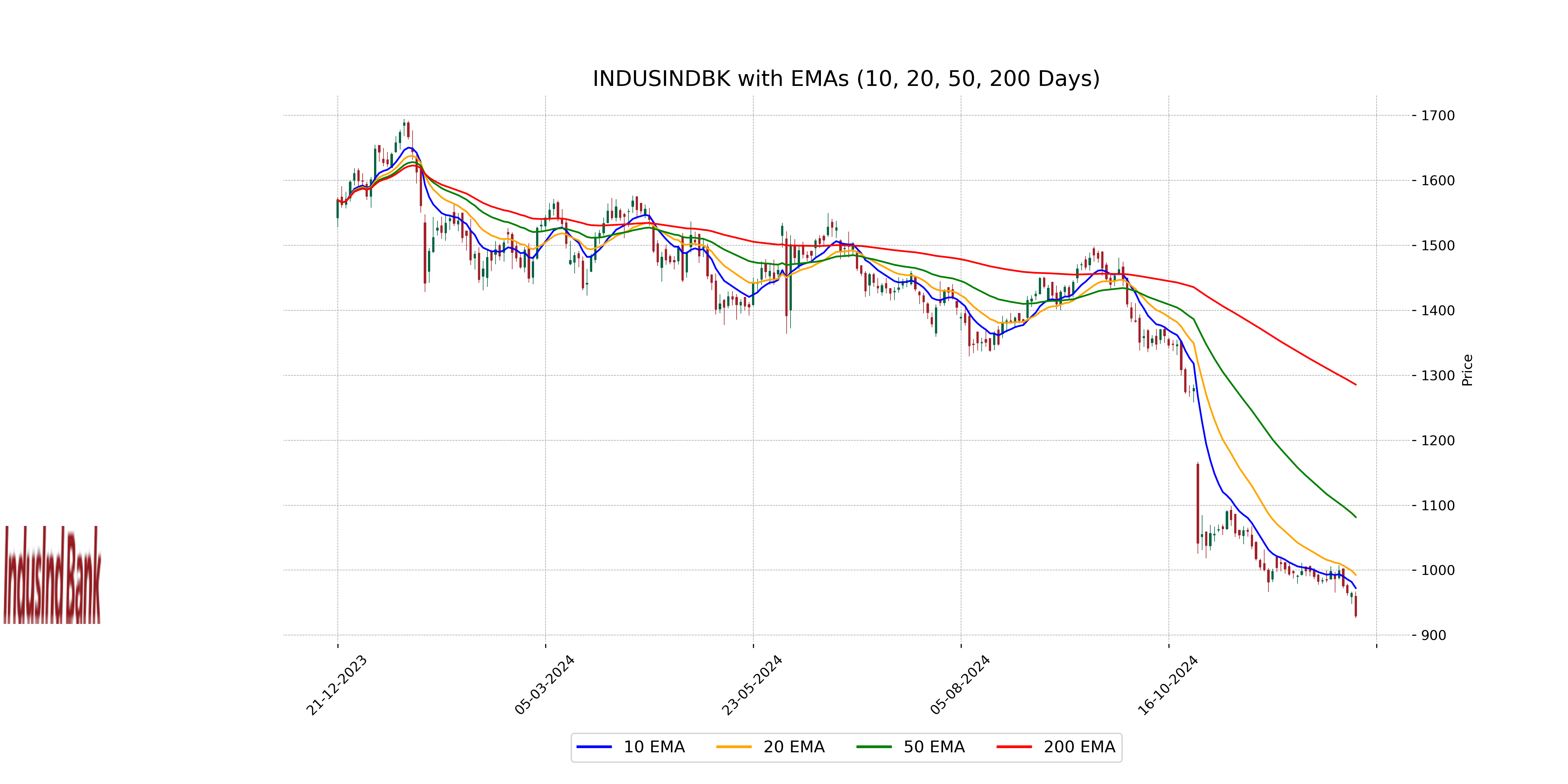

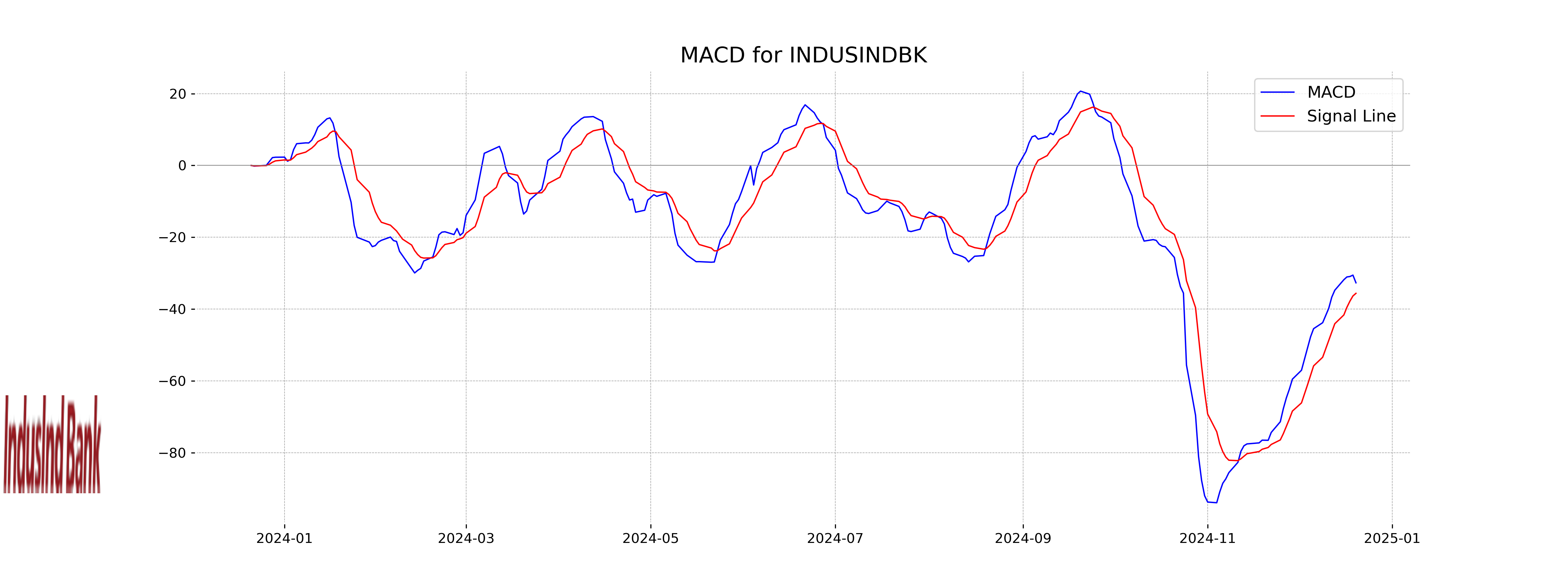

- Tech Mahindra, Axis Bank, IndusInd Bank signal bearish trends

- RSI indicates oversold conditions for potential reversals

Latest news

Global stock market indices: How the world markets performed today - 21 March 2025

Indian stock market sector-wise performance today - March 21, 2025

Top 5 Nifty 50 gainers today – March 21, 2025: Biggest stock moves

NSE Nifty 50: Top 5 stock losers of March 21, 2025

Uttarakhand CM Dhami highlights three years of governance, women empowerment, and growth

Over 50,000 youth given self-employment in three years: Uttarakhand CM

Kuldeep Singh Dhaliwal holds 4th Monthly online NRI Milnee to resolve the grievances of NRI Punjabis

Bulldozer action on properties of two drug peddlers in Punjab's Fazilka

Nifty 50: Top losers today - 20 December 2024

Up Next

Nifty 50: Top losers today - 20 December 2024

Indian stock market sector-wise performance today - March 21, 2025

Top 5 Nifty 50 gainers today – March 21, 2025: Biggest stock moves

NSE Nifty 50: Top 5 stock losers of March 21, 2025

Global stock market indices: How the world markets performed today - 20 March 2025

Indian stock market sector-wise performance today - March 20, 2025

More videos

Top 5 Nifty 50 gainers today – March 20, 2025: Biggest stock moves

NSE Nifty 50: Top 5 stock losers of March 20, 2025

Vodafone Idea explores satellite partnerships amid competitor moves

Global stock market indices: How the world markets performed today - 19 March 2025

Indian stock market sector-wise performance today - March 19, 2025

Top 5 Nifty 50 gainers today – March 19, 2025: Biggest stock moves

Global stock market indices: How the world markets performed today - 18 March 2025

Indian stock market sector-wise performance today - March 18, 2025

Top 5 Nifty 50 gainers today – March 18, 2025: Biggest stock moves

NSE Nifty 50: Top 5 stock losers of March 18, 2025