In this article, we will explore the technical indicators of some of the low-performing stocks on the Indian stock market, including ADANIENT, ADANIPORTS, COALINDIA, DRREDDY, and INDUSINDBK.

By looking at these stocks through the lens of key technical factors, we aim to better understand their price movements, trends, and potential future performance.

Analysis for Adani Enterprises - March 25, 2025

Adani Enterprises experienced a decrease of 2.04% in its stock price, closing at 2320.35 compared to the previous close of 2368.70. Despite the decline, the company maintains a strong RSI of 56.89 and a favorable MACD above its signal line, suggesting potential bullish momentum. The stock operates within the Energy sector, specifically in the Thermal Coal industry, with a market cap of approximately 2.68 trillion INR.

Relationship with Key Moving Averages

Adani Enterprises, with a close price of 2320.35, is trading above its 10 EMA of 2300.76 and 50 EMA of 2301.07, indicating short-term upward momentum. However, it remains below the 200 EMA of 2602.94, suggesting a longer-term downtrend relative to its historical performance.

Moving Averages Trend (MACD)

Adani Enterprises' MACD is 23.95, considerably above the MACD Signal line of 3.71, indicating a strong bullish momentum. This might suggest a positive trend reversal or a continuation of upward movement if the trend maintains. However, it's essential to consider other indicators and market conditions for comprehensive analysis.

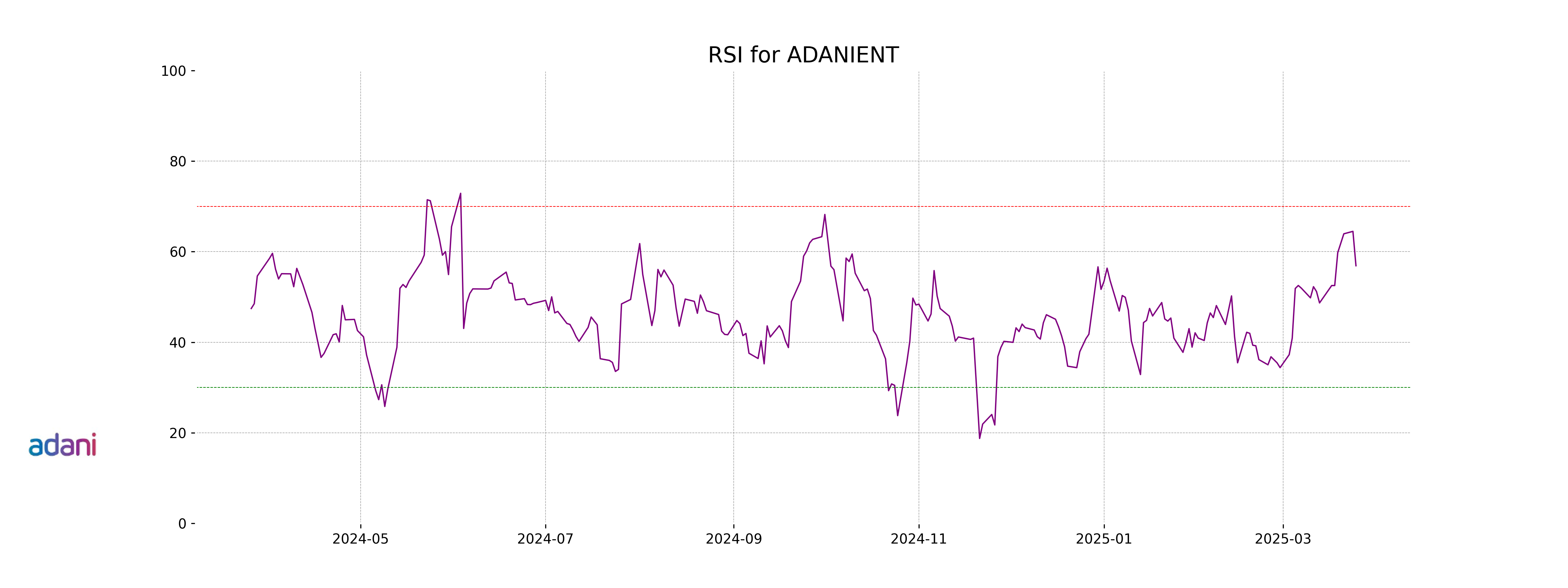

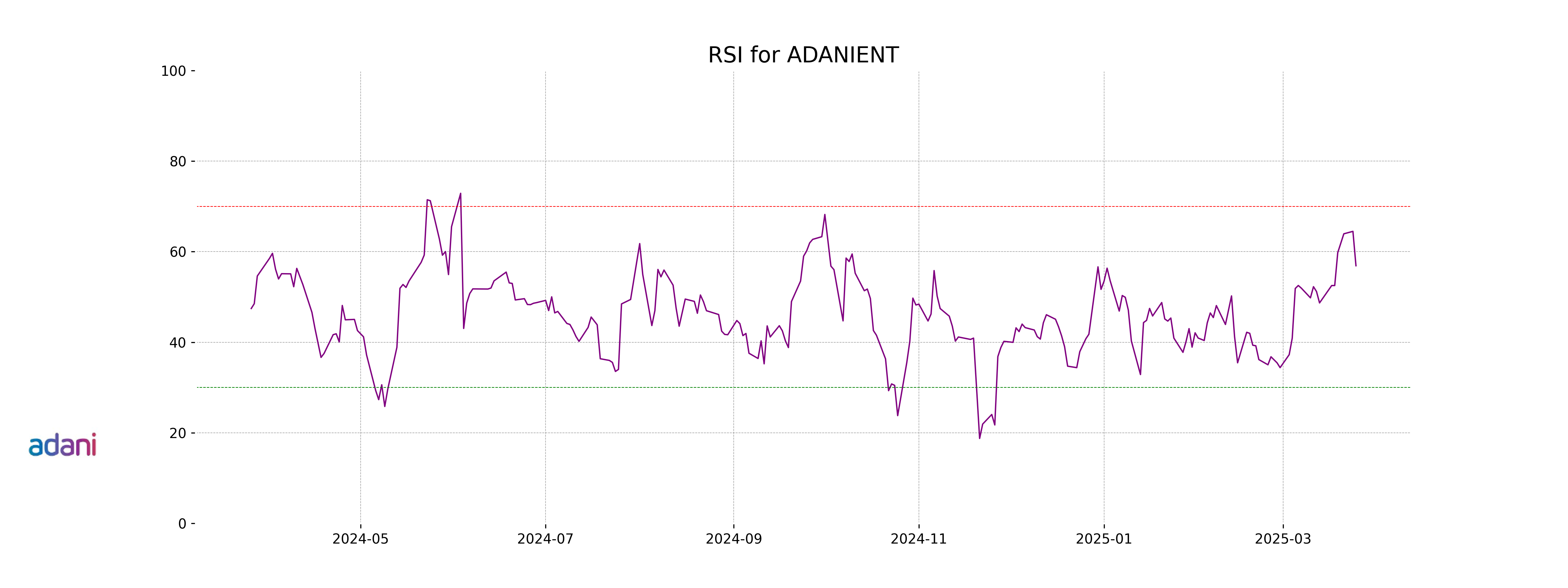

RSI Analysis

### RSI Analysis for Adani Enterprises The Relative Strength Index (RSI) for Adani Enterprises stands at approximately 56.89, indicating a neutral market position. This suggests that the stock is neither overbought nor oversold, with room for potential upward or downward movement depending on the overall market trends and investor sentiment.

Analysis for Adani Ports - March 25, 2025

Adani Ports closed at 1182.45, down by -1.53% from the previous close of 1200.80. The stock's performance shows a decline with a MACD suggesting bullish momentum and an RSI indicating it is neither overbought nor oversold. With a market cap of 2.55 trillion, it operates in the Marine Shipping industry in India's industrial sector.

Relationship with Key Moving Averages

Based on the data, Adani Ports is trading above its 50-day EMA but below its 200-day EMA. The current price is also above the 10-day and slightly above the 20-day EMAs. This indicates a short-term upward momentum amidst a longer-term bearish trend.

Moving Averages Trend (MACD)

Adani Ports exhibits a bullish signal with its MACD line at 20.25, which is above the MACD Signal line at 11.17. This suggests a potential upward momentum in the stock's price trend.

RSI Analysis

The Relative Strength Index (RSI) for Adani Ports is 62.09, indicating that the stock is neither overbought nor oversold, as it remains in the neutral zone. Generally, an RSI above 70 suggests overbought conditions, while below 30 indicates oversold conditions.

Analysis for Coal India - March 25, 2025

Coal India observed a negative performance in recent trading, with a closing price of 398.30 INR, reflecting a decrease of approximately 1.90% from its previous close of 406.00 INR. Although the stock remains above its 50-day EMA of 381.45 INR, it is slightly below its 200-day EMA, indicating potential resistance levels. The market cap stands at approximately 2.45 trillion INR, positioning it as a significant entity in the energy sector, particularly within the thermal coal industry in India.

Relationship with Key Moving Averages

Based on the data, Coal India's stock is trading below its previous close of 406.0, with a current close of 398.3. The stock is above its 50 EMA of 381.45 and near its 200 EMA of 401.22, indicating some upward momentum over the short term but testing the long-term trend.

Moving Averages Trend (MACD)

The MACD for Coal India is currently at 8.04, which is above the MACD signal line of 4.97. This suggests a bullish trend, indicating the possibility of upward momentum in the stock price.

RSI Analysis

Coal India currently has an RSI of 62.53, which suggests that the stock is in the neutral zone, leaning towards being overbought but not yet in the overbought territory (above 70). This indicates that the stock's price is neither greatly undervalued nor overvalued at the moment, and it may continue with its current trend unless other indicators suggest otherwise.

Analysis for Dr Reddys Labs - March 25, 2025

Dr. Reddys Labs delivered a closing price of 1177.90, marking a decline of 2.68% from the previous close of 1210.30, with a volume of 2,860,801 shares traded. The stock's performance aligns with key technical indicators, such as a 50-day EMA of 1192.40 and a 200-day EMA of 1235.72, suggesting a bearish momentum with its MACD at -1.64 and RSI at 52.54.

Relationship with Key Moving Averages

Dr Reddy's Laboratories' current closing price of 1177.90 is below its 50-day EMA of 1192.40 and its 200-day EMA of 1235.72, suggesting a bearish trend relative to these averages. However, it is above the 10-day EMA of 1169.35 and the 20-day EMA of 1163.80, indicating potential short-term support.

Moving Averages Trend (MACD)

Dr Reddy's Laboratories' MACD value is -1.64, which is above its MACD Signal of -14.03. This indicates a potential bullish momentum, as the MACD line is moving closer to crossing above the signal line. A cross above would confirm a buy signal, suggesting increasing positive momentum for the stock.

RSI Analysis

Dr Reddys Labs has a Relative Strength Index (RSI) of 52.54, indicating a neutral position. This suggests that the stock is neither overbought nor oversold at the moment. With the RSI near the mid-point of 50, the stock might be in a stable zone, but traders should watch for any emerging trends.

Analysis for IndusInd Bank - March 25, 2025

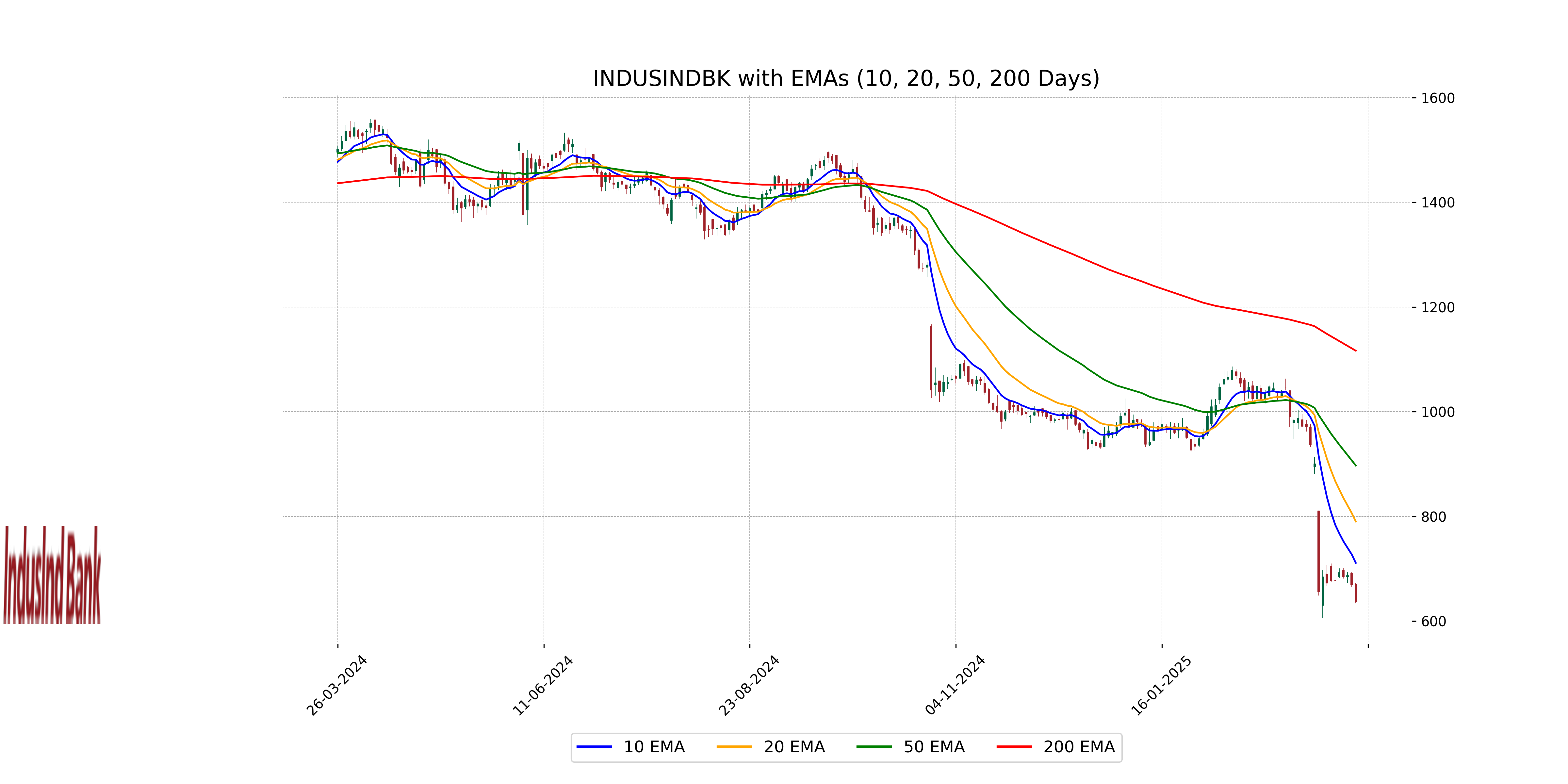

IndusInd Bank experienced a decline in its stock performance, with a closing price of 637.05, down by 4.84% from the previous close. The stock's Relative Strength Index (RSI) is notably low at 19.23, indicating potential oversold conditions. Despite a market cap of approximately 496.3 billion and a PE ratio of 6.85, its stock currently trades below significant moving averages including the 50 EMA and 200 EMA.

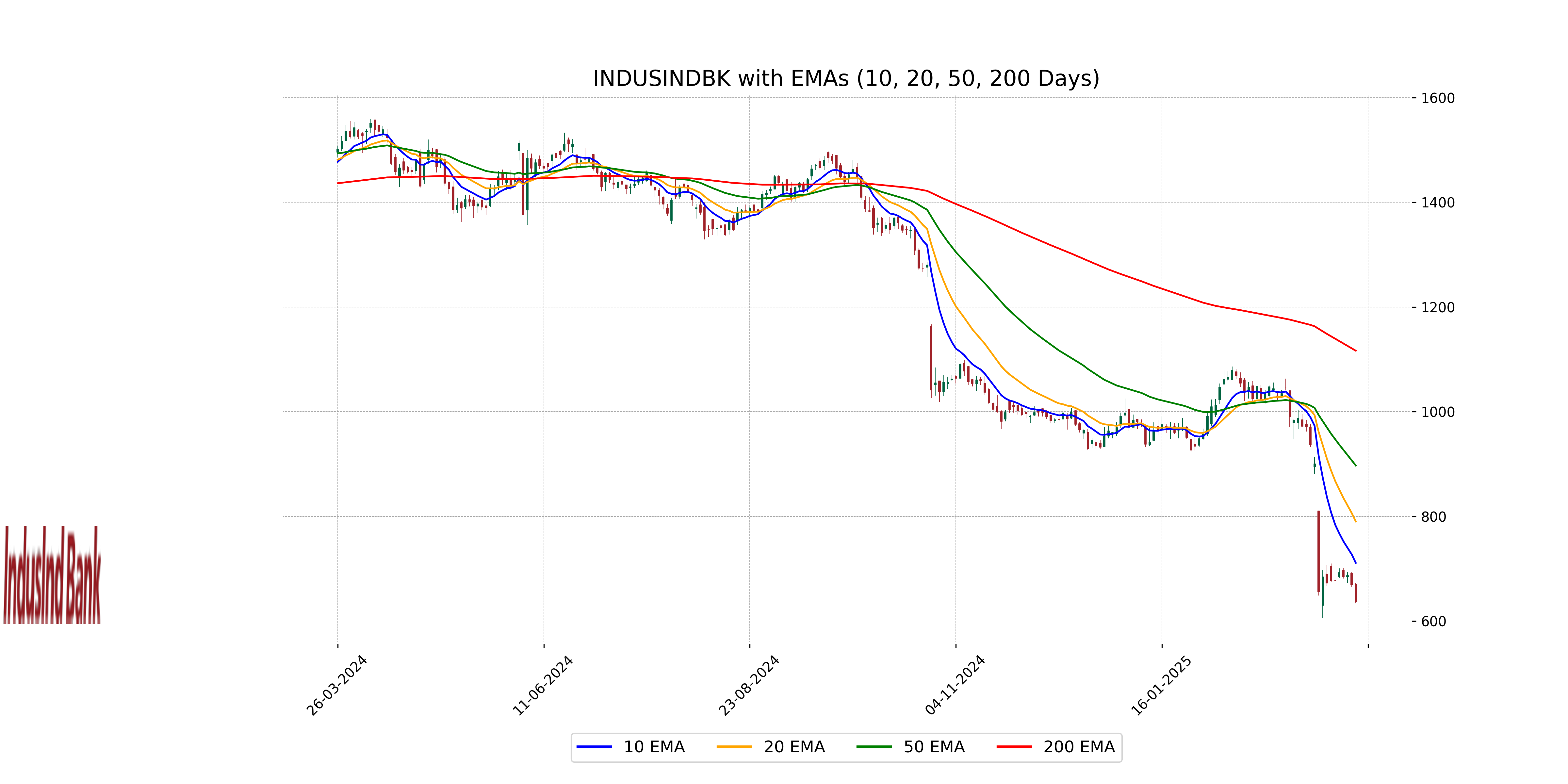

Relationship with Key Moving Averages

IndusInd Bank's current stock price of 637.05 is significantly below its key moving averages, including the 50 EMA at 897.25 and the 200 EMA at 1116.46, indicating a strong bearish trend. Additionally, the 10 EMA and 20 EMA, at 711.10 and 790.49 respectively, are also above the current price, further underscoring the downward momentum.

Moving Averages Trend (MACD)

The MACD value for IndusInd Bank is -93.87, while the MACD Signal is -78.20. This indicates a bearish signal as the MACD line is below the signal line, suggesting potential downside momentum in the stock price.

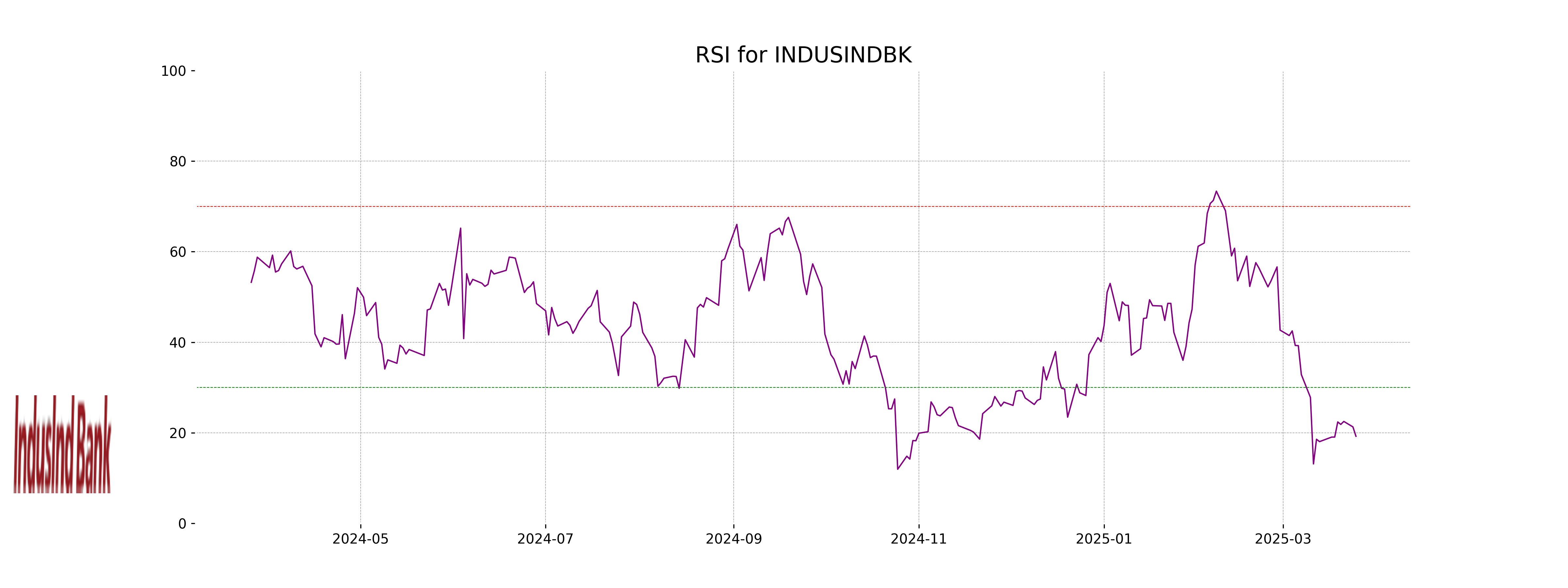

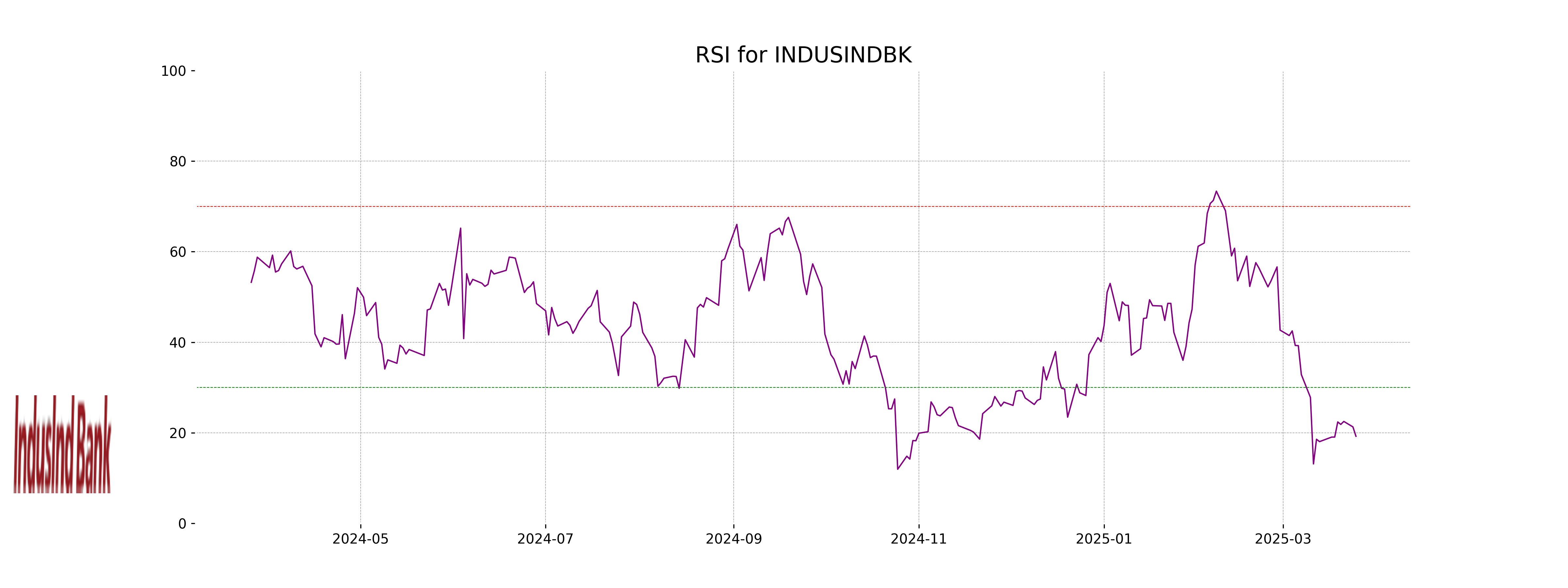

RSI Analysis

IndusInd Bank's RSI (Relative Strength Index) is at 19.23, which suggests that the stock is in the oversold territory. Typically, an RSI below 30 indicates that a stock is potentially undervalued or experiencing bearish momentum, suggesting possible opportunities for buyers if other indicators align.